What is the dominant approach for budgeting used today? This question sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. As we delve into the intricacies of budgeting, we will explore the various methods employed in contemporary financial management, examining their benefits, drawbacks, and the factors that influence their adoption.

Our journey will encompass zero-based budgeting, envelope budgeting, digital budgeting, and hybrid budgeting, shedding light on their respective strengths and limitations. Furthermore, we will venture into the realm of emerging trends in budgeting, uncovering how technology is shaping the future of this essential financial practice.

Common Budgeting Approaches

Budgeting plays a pivotal role in personal finance, enabling individuals to plan and control their financial resources effectively. Today, there is a wide range of budgeting approaches available, each with its unique benefits and drawbacks.

The choice of budgeting approach depends on factors such as income level, financial goals, and personal preferences. Some of the most common budgeting methods include:

- Zero-Based Budgeting

- Envelope Budgeting

- Digital Budgeting

- Hybrid Budgeting

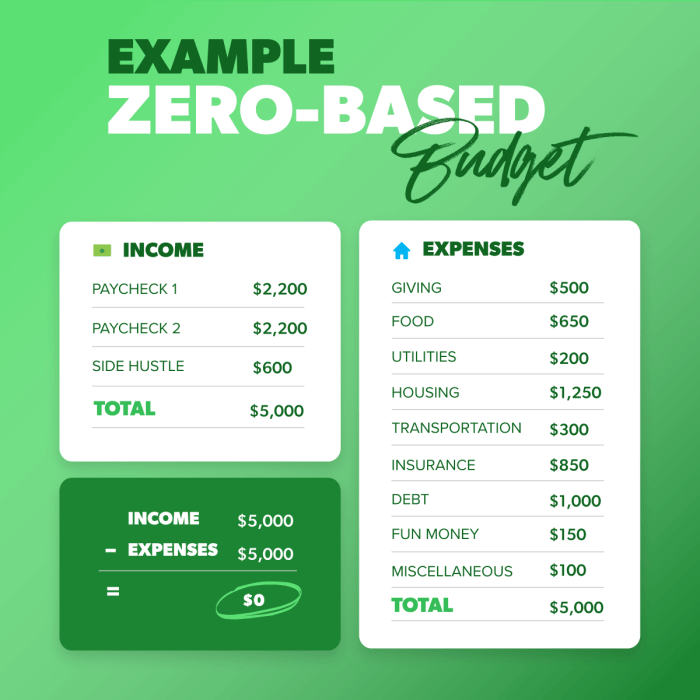

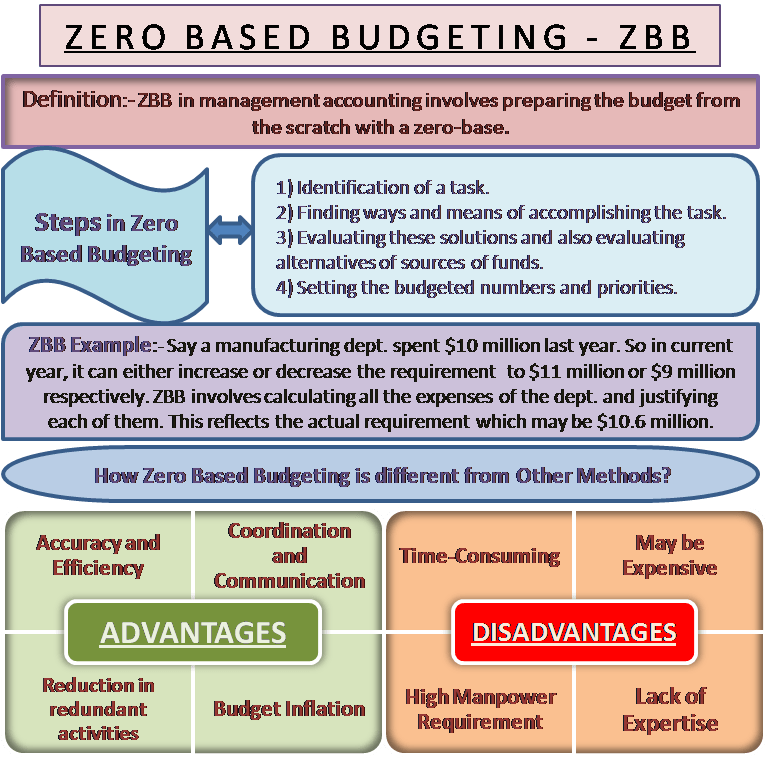

Zero-Based Budgeting

Zero-based budgeting is a budgeting method where every dollar of income is allocated to a specific category. The goal is to ensure that all income is accounted for, with no surplus or deficit at the end of the month.

To create a zero-based budget, follow these steps:

- List all sources of income.

- List all fixed expenses (e.g., rent, mortgage, car payment).

- List all variable expenses (e.g., groceries, entertainment, dining out).

- Allocate every dollar of income to a specific category.

- Adjust the budget as needed throughout the month.

Zero-based budgeting can be effective for individuals who want to gain complete control over their finances and ensure that all income is used wisely.

Envelope Budgeting, What is the dominant approach for budgeting used today

Envelope budgeting is a physical budgeting method where cash is allocated into different envelopes for specific categories (e.g., groceries, entertainment, dining out).

To implement envelope budgeting:

- Determine the budget for each category.

- Withdraw cash for each category.

- Place the cash in labeled envelopes.

- Spend only the cash from the designated envelope for that category.

Envelope budgeting can be beneficial for individuals who struggle with overspending or who prefer a more tangible budgeting approach.

Digital Budgeting

Digital budgeting utilizes budgeting apps or software to track income and expenses. These tools offer features such as:

- Automatic transaction tracking

- Budgeting templates

- Financial reports

- Mobile access

Digital budgeting can be convenient and effective for individuals who want to automate their budgeting process and access their financial information on the go.

Hybrid Budgeting

Hybrid budgeting combines traditional and digital budgeting methods. For example, individuals may use a digital budgeting app to track their income and expenses, while also using physical envelopes for certain categories (e.g., groceries).

Hybrid budgeting can be a flexible approach that allows individuals to customize their budgeting system to suit their needs and preferences.

Emerging Trends in Budgeting

Technology is continuously shaping the future of budgeting. Some emerging trends include:

- Artificial intelligence (AI)-powered budgeting tools

- Gamification of budgeting

- Personalized budgeting recommendations

- Integration with financial planning tools

These trends have the potential to make budgeting more accessible, engaging, and effective for individuals.

Commonly Asked Questions: What Is The Dominant Approach For Budgeting Used Today

What are the key principles of zero-based budgeting?

Zero-based budgeting is a method of budgeting where every dollar is allocated to a specific category, ensuring that all income is accounted for. It requires a detailed plan of all expenses, both fixed and variable, and assigns each dollar to a specific purpose.

What are the advantages of using digital budgeting tools?

Digital budgeting tools offer several advantages, including ease of use, automatic tracking of expenses, categorization of transactions, and the ability to create budgets and monitor progress in real-time.

What are the potential challenges of using a hybrid budgeting approach?

Hybrid budgeting, which combines traditional and digital methods, can be challenging to implement and maintain effectively. It requires discipline and attention to detail to ensure that all transactions are captured and accounted for accurately.