Which accurately describes the terms of this mortgage – Navigating the intricacies of a mortgage agreement can be daunting, but understanding the terms is crucial for making informed decisions. This comprehensive guide will delve into the key elements of a mortgage, providing clarity and empowering you to confidently navigate the homeownership journey.

Mortgage Terms and Conditions

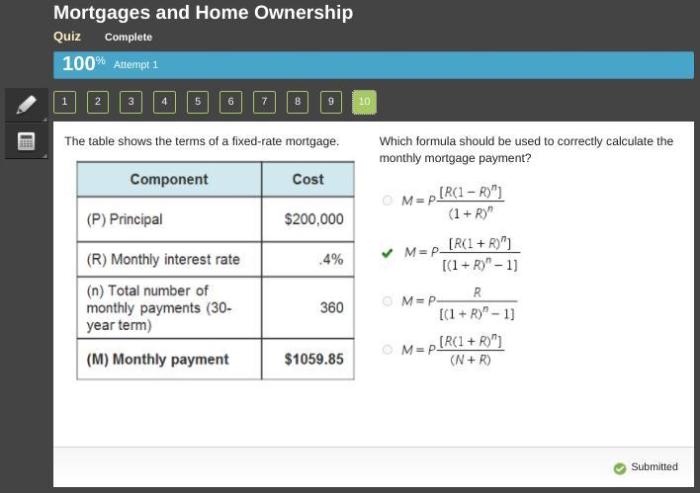

The terms and conditions of a mortgage Artikel the key details of the loan, including the loan amount, interest rate, loan term, and monthly payment. These terms determine the total cost of the loan and the borrower’s obligations over the life of the loan.

Loan Amount

The loan amount is the amount of money borrowed from the lender to purchase the property. This amount is typically a percentage of the property’s appraised value.

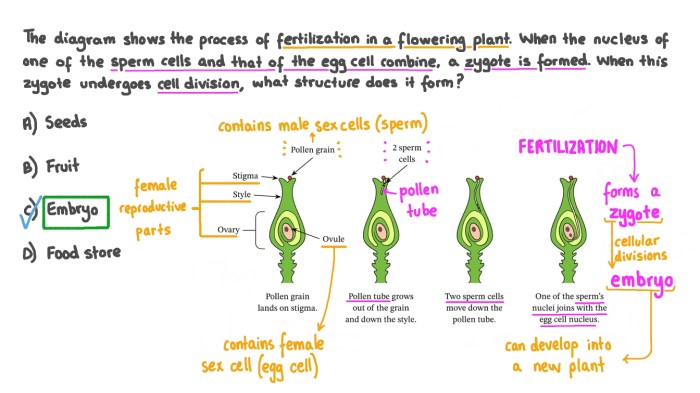

Interest Rate

The interest rate is the percentage of the loan amount that the borrower pays each year in exchange for borrowing the money. Interest rates can be fixed or adjustable, and they have a significant impact on the total cost of the loan.

Loan Term

The loan term is the length of time over which the loan is repaid. Common loan terms include 15 years, 20 years, and 30 years. A shorter loan term results in higher monthly payments but lower total interest paid over the life of the loan.

Monthly Payment

The monthly payment is the amount of money the borrower pays to the lender each month to repay the loan. This payment includes principal, interest, taxes, and insurance (PITI).

Additional Fees and Charges

In addition to the loan amount, interest rate, loan term, and monthly payment, there may be additional fees and charges associated with the mortgage. These fees can include origination fees, closing costs, and annual fees.

Summary of Mortgage Terms

The mortgage terms and conditions provide a clear and concise overview of the key details of the loan. This information is essential for borrowers to understand the full cost of the loan and their obligations before signing the mortgage agreement.

Loan Repayment: Which Accurately Describes The Terms Of This Mortgage

Loan repayment is the process of paying back the borrowed amount, along with interest, over the life of the loan. The repayment schedule Artikels the amount of each payment and how much of it goes towards principal and interest.

Payment Schedule

The payment schedule is a detailed breakdown of the loan repayment process. It shows the amount of each monthly payment, the portion of the payment that goes towards principal and interest, and the remaining balance on the loan.

Total Interest Paid

The total interest paid over the life of the loan is the sum of all the interest payments made during the repayment period. This amount can be significant, especially for long-term loans with high interest rates.

Impact of Interest Rates and Loan Terms

Different interest rates and loan terms can have a significant impact on the total cost of the loan. Higher interest rates result in higher monthly payments and a higher total interest paid over the life of the loan. Shorter loan terms also result in higher monthly payments but lower total interest paid.

Example of Loan Repayment Schedule

A loan repayment schedule can be a valuable tool for borrowers to track their progress in repaying the loan. It can also help borrowers identify potential areas for savings or prepayment.

Prepayment and Penalties

Prepayment refers to the option of paying off the mortgage balance early, either in part or in full. However, some mortgages may come with prepayment penalties, which are fees charged by the lender for prepaying the loan.

Options for Prepaying

Borrowers may have the option to prepay their mortgage in a lump sum or by making extra payments towards the principal. Lump sum prepayments can significantly reduce the total interest paid over the life of the loan.

Prepayment Penalties, Which accurately describes the terms of this mortgage

Prepayment penalties are fees charged by the lender for prepaying the loan. These penalties can vary depending on the terms of the mortgage and the amount of the prepayment.

Advantages and Disadvantages of Prepaying

Prepaying the mortgage can offer several advantages, such as reducing the total interest paid and building equity in the property faster. However, there may also be disadvantages, such as the potential for prepayment penalties and the opportunity cost of using the funds for other investments.

Examples of Prepayment Penalties

Prepayment penalties can vary widely depending on the terms of the mortgage. Some common types of prepayment penalties include:

- Flat fee penalties

- Percentage of the loan balance penalties

- Yield spread premiums

Default and Foreclosure

Default occurs when a borrower fails to make mortgage payments on time. Defaulting on the mortgage can have serious consequences, including foreclosure.

Consequences of Default

Defaulting on the mortgage can result in a number of consequences, including:

- Late fees and penalties

- Damage to credit score

- Foreclosure

Foreclosure Process

Foreclosure is the legal process by which the lender takes possession of the property and sells it to satisfy the outstanding mortgage debt. The foreclosure process can be complex and time-consuming.

Rights of the Borrower During Foreclosure

Borrowers have certain rights during the foreclosure process, including the right to:

- Receive notice of the foreclosure

- Contest the foreclosure

- Redeem the property

Examples of Foreclosure Proceedings

Foreclosure proceedings can vary depending on the laws of the state in which the property is located. However, some common steps in the foreclosure process include:

- Notice of default

- Foreclosure sale

- Redemption period

Essential Questionnaire

What is the loan term?

The loan term refers to the duration over which the mortgage will be repaid, typically ranging from 15 to 30 years.

What is the impact of interest rates on my mortgage?

Interest rates significantly influence the total cost of your mortgage. Higher interest rates lead to higher monthly payments and overall interest paid.

Can I prepay my mortgage without penalty?

Prepayment penalties vary depending on the mortgage terms. Some mortgages allow for penalty-free prepayment, while others may impose fees for early repayment.